How To Prepare For End of Financial Year

6 Tips to Prepare Your Small Business for EOFY

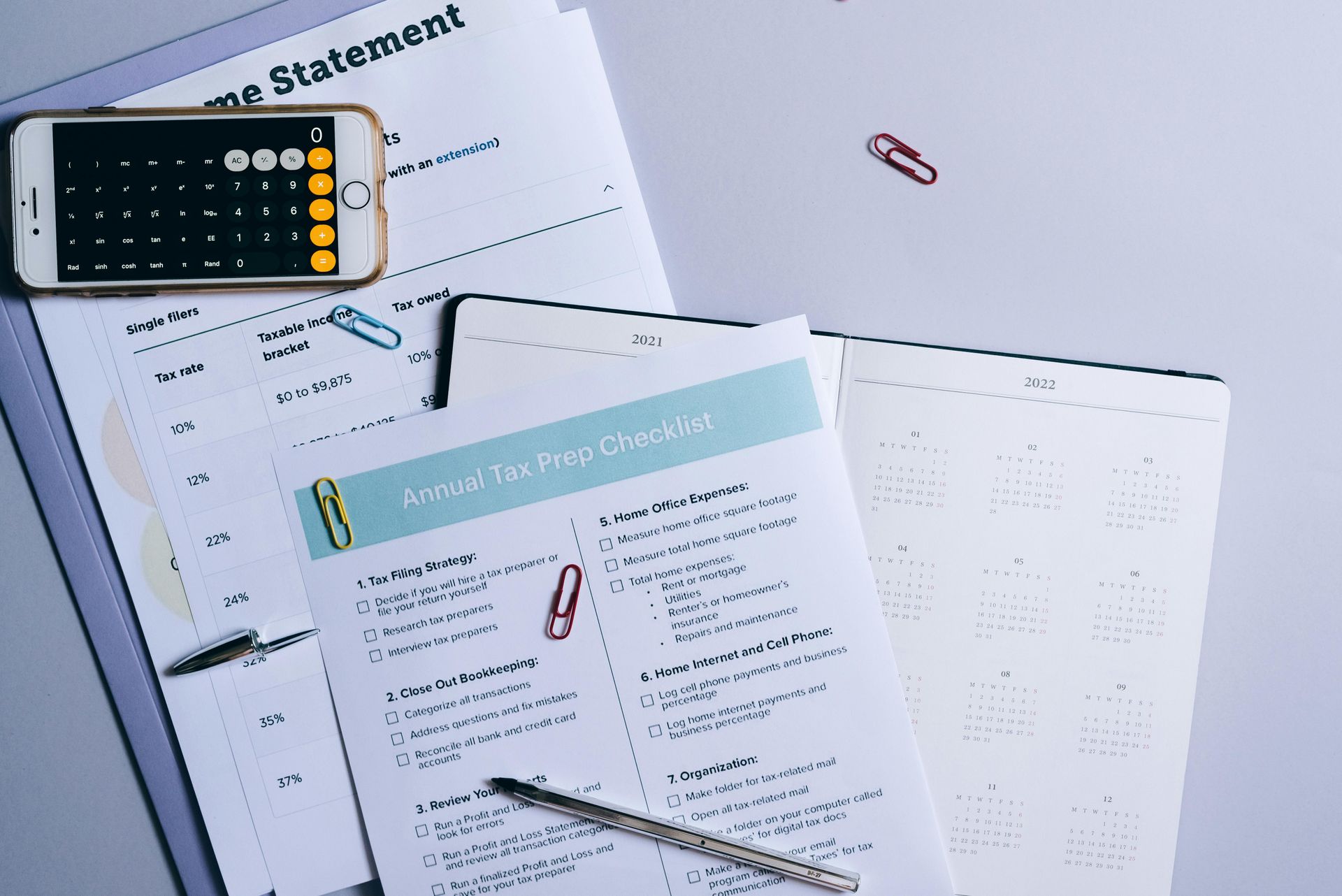

As the end of the financial year (EOFY) approaches, it’s time to get everything in order for 2024 tax time. Don’t worry – preparing for EOFY doesn’t have to be stressful. With a bit of organisation, the right tools, and some expert advice, you can streamline the process and focus on what you do best: running your business. Here’s a friendly guide to help you navigate the EOFY smoothly and efficiently.

Feeling overwhelmed? Send us an email, and we'll prepare your financial documents for your 2024 tax return!

Organise Your Financial Records

First things first: get your financial records in order. Make sure everything is up to date and accurately reflects your business transactions. Here’s what to collect:

- Bank Statements: Reconcile your bank accounts to ensure all transactions are recorded.

- Invoices and Receipts: Gather and organise all your invoices and receipts for income and expenses.

- Payroll Records: Ensure your payroll records, including superannuation payments and employee entitlements, are accurate and current.

Accounting software like Xero, MYOB, or QuickBooks can simplify this process by automating much of the data entry and reconciliation.

Review And Reconcile Accounts

Next, give your accounts a thorough review and reconciliation. This includes:

- Accounts Payable and Receivable: Ensure all outstanding invoices are paid and any unpaid customer invoices are chased up.

- Inventory: Conduct a stocktake to match physical inventory with accounting records.

- Asset Register: Update your asset register, including details of any assets bought, sold, or disposed of during the year.

Assess Your Financial Performance

Take a step back and examine how your business performed over the past year. Key areas to focus on include:

- Profit and Loss Statement: Review your income and expenses to determine profitability.

- Balance Sheet: Assess your business’s financial position by examining assets, liabilities, and equity.

- Cash Flow Statement: Evaluate your cash inflows and outflows to ensure your business has adequate liquidity.

Maximise Tax Deductions and Concessions

Nobody wants to pay more tax than they need to, so make sure you’re taking advantage of all available deductions. Common deductions include:

- Operating Expenses: Deduct expenses related to the day-to-day running of your business, such as rent, utilities, and office supplies.

- Depreciation: Claim depreciation on business assets, including the immediate deduction for assets costing less than $20,000 under the instant asset write-off scheme.

- Superannuation Contributions: Ensure all employee superannuation contributions are up to date and consider making additional contributions for yourself.

Consult with Profit Services today to ensure you maximise your deductions and comply with tax laws.

Prepare and Lodge Your Tax Return

Now it’s time to prepare your tax return. Make sure you have all necessary documentation ready, such as:

- BAS Statements: Ensure all Business Activity Statements (BAS) are lodged and up to date.

- Taxable Payments Annual Report (TPAR): If you’ve made payments to contractors, ensure you lodge your TPAR.

- Single Touch Payroll (STP): Confirm that your payroll reporting is compliant with STP requirements.

Work with Profit Services to prepare your financial reporting so you can lodge your tax return on time and avoid any penalties for late submission.

Plan for the New Financial Year

Use the insights gained from your EOFY review to plan for the upcoming financial year. Consider the following:

- Financial Review: Sit down with a bookkeeper or accountant, like Profit Services, to review your past year’s financials. Assess whether you met your targets and identify areas for improvement.

- Strategic Planning: Set strategic objectives for growth, including marketing strategies, product development, and expansion plans.

- Cash Flow Management: Plan ways to keep your cash flow steady, like improving your invoicing process and cutting unnecessary costs.

- Budgeting: Create a budget that aligns with your financial goals and anticipated expenses for the year ahead.

What’s Next?

Get Expert Advice

Remember, the EOFY is not just about compliance; it’s an opportunity to review your performance, plan for the future, and ensure your business’s financial health. For personalised advice tailored to your specific circumstances, engage with Profit Services today! We can help you stay compliant and optimise your financial strategies.

About the Author

Fabian Ianniello is a CPA accountant and the founder of Profit Services, a firm dedicated to transforming small businesses through effective financial management and strategic advisory. With over 15 years of corporate and commercial experience spanning from small enterprises to multinational corporations, Fabian specialises in enhancing cash flow and profitability for his clients. His proactive and forward-thinking approach ensures that businesses not only achieve financial stability, but also attain scalability and saleability. Fabian implements impactful changes that yield significant results, guiding entrepreneurs toward sustainable success.